Women receiving aid have fewer children than women who are not receiving aid (Handler and Hasenfeld 2007:53). Further, there is no evidence that the children they are having are viewed as meal tickets; in fact, evidence suggests it is quite the opposite.

Reasons Women Have Children

Women have children for many reasons. Some pregnancies are intended, planned and/or desired; others are not. For those that are intended, women balance a number of complex issues in order to reach their decision to have another child.1 Finances can be a consideration, but typically in terms of whether a person feels they can afford to have another child.2 Despite the stories that circulate, there is no research that indicates women have children expecting to improve their financial situation.

Having More Children Doesn’t Pay Much

TANF

Some people tell stories about women who have more babies in order to increase their benefits. The story is tough to shake, appearing in print as early as 19593 and still shared regularly today. Over half of Americans believe welfare encourages women to have more children.4 The evidence, however, suggests otherwise. With the welfare reforms of 1996, a woman who gets pregnant while receiving TANF funds cannot apply for TANF funds for that child.5

Having more children, therefore, does not reap larger TANF benefits.

Now for argument’s sake, let’s take the scenario—even more unlikely than choosing to have children for an increase in one’s TANF check—of a woman who is not currently receiving TANF, but who plans to apply and before doing so, calculates the increase in benefits for more children. In North Carolina, for each additional child, she would receive an average of $28 per month,6 hardly an incentive to add a new person to the family.

Further, these low numbers should force us to ask whether these amounts are sufficient to raise a child. Although the legends would have us believe the amounts are too high, the reality is that they are likely too low. And since there is no data that suggests women base their procreative decisions on welfare benefit amounts, we should be considering raising, not cutting, these amounts.

Food Stamps

However, because the government wants to ensure that children are properly fed, additional children may be eligible for SNAP or food stamps. Does this additional money in food stamps provide sufficient motivation for women to have more children? The numbers suggest no. Here’s why:

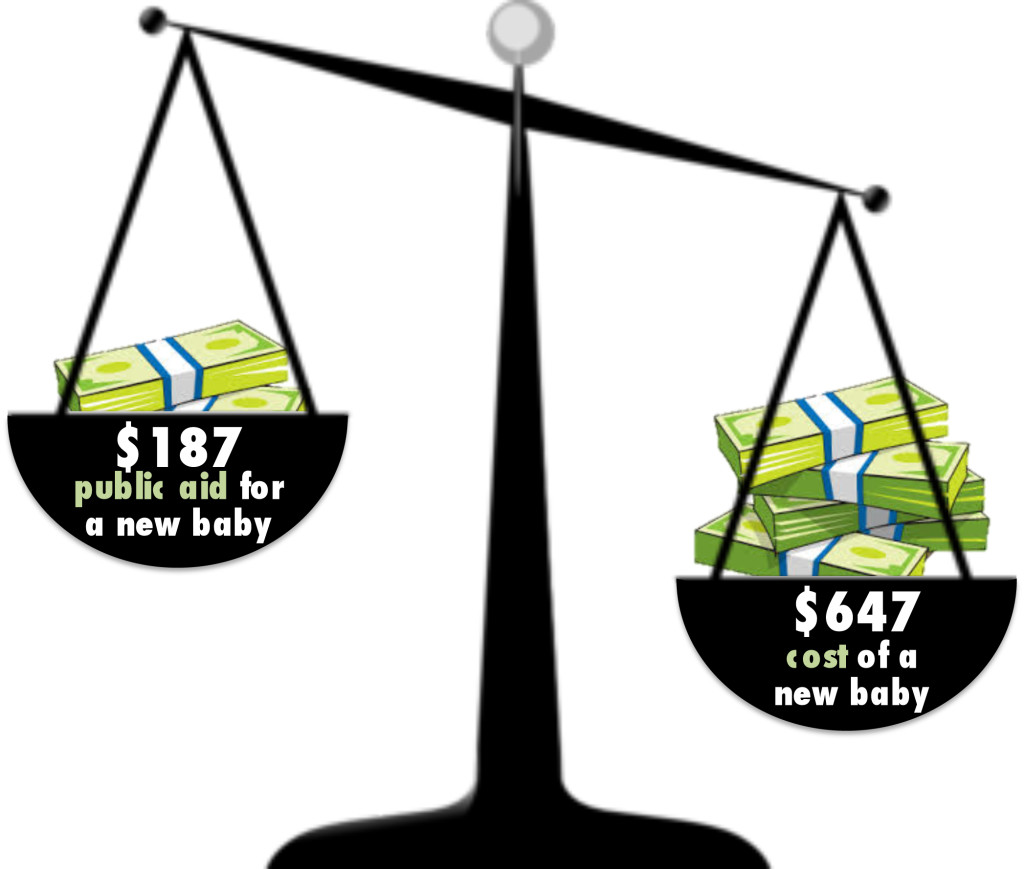

A new child could raise a family’s SNAP benefits by $159 per month. But as we saw in Truth #1, food is expensive and even the maximum amount of food stamps barely covers the most frugal diet developed by the USDA. Is this enough to entice a woman to have a child? Perhaps, but doubtful. $159 hardly covers the costs of raising a child. For families in the lowest income bracket, the USDA estimates that a single-parent family will spend an average of $7,760 per child per year.7 That’s $647/month. Of course, that’s an average. But even if the parent considers only the most basic expenses of food, diapers, and clothing, and assuming that health care could be covered by Medicaid, $159 in food stamps plus $28 in TANF for a total of $187 per month does not go very far.

A new child could raise a family’s SNAP benefits by $159 per month. But as we saw in Truth #1, food is expensive and even the maximum amount of food stamps barely covers the most frugal diet developed by the USDA. Is this enough to entice a woman to have a child? Perhaps, but doubtful. $159 hardly covers the costs of raising a child. For families in the lowest income bracket, the USDA estimates that a single-parent family will spend an average of $7,760 per child per year.7 That’s $647/month. Of course, that’s an average. But even if the parent considers only the most basic expenses of food, diapers, and clothing, and assuming that health care could be covered by Medicaid, $159 in food stamps plus $28 in TANF for a total of $187 per month does not go very far.

Evidence Does Not Support the Legends

But let’s not leave it to numbers and assumptions of rational decision making. If women were motivated by increased benefits to have more children, we should expect to see a correlation between benefit levels and birth rates among poor women. But studies show no such correlation.8 Further, we should see higher birth rates among aid recipients in states that provide relatively higher benefits. But again, we do not.9 Finally, as benefits drop, so should birth rates among aid recipients. Again, we see no such drop.

Stories about women having more babies for small increases in their food stamp benefits—increases quickly offset by associated costs with having an additional child—simply are not supported, not by the numbers, not by the policies, not by the trends, and not by logic. Similar increases in benefits for additional children are granted to the middle class who get a tax credit of up to $1000 per child, yet no one assumes these middle class families are having more children for the tax break.