Apr

09

2011

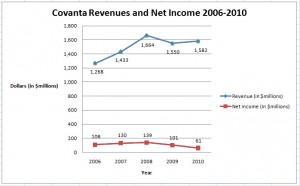

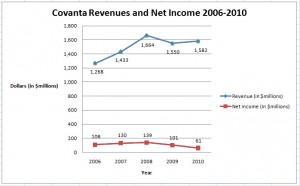

Covanta Holdings Corporation has seen an increase in revenues within the last year. The company has always been financially sound. It struggled, as all companies did within the waste management services industry did after the recession crisis in 2008. The company has steadily been increasing revenue since then as people are once again increasing their purchases and therefore increases waste.

Covanta’s profit margin however has slowly been decreasing. This is due to a decrease in their net income, or earnings. The company has been spending their money on acquisitions in Asia as well as expanding their services in the United States. The company is spending money on finding new ways to create reusable energy from waste.

Posted in Waste Management Services, Covanta Holding Corporation | 1 Comment »

Apr

05

2011

Covanta Holdings Corporation competes in the Waste Management Services Industry. The total revenues of this industry in 2010 were $15.1 billion. The industry itself seems to be steadily growing. This is due to increased waste. As more people inhabit the earth and the standard of living of people increases, their is more purchasing power. The more people are able to purchase, the greater the increase in waste. During years of recession, such as in 2008 and 2009, there was a large decrease in waste due to decrease in purchasing power. The industry took a hit between 2007 and 2008. The industry growth went from 4.8% growth in 2007 to -3.8% growth in 2008.

Revenue Growth

| Year |

Revenue $ million |

Growth % |

| 1997 |

13,814.8 |

|

| 1998 |

12,569.0 |

-9.0 |

| 1999 |

12,842.4 |

2.2 |

| 2000 |

13,949.2 |

8.6 |

| 2001 |

13,953.8 |

0.0 |

| 2002 |

13,023.6 |

-6.7 |

| 2003 |

13,231.1 |

1.6 |

| 2004 |

13,260.8 |

0.2 |

| 2005 |

13,914.6 |

4.9 |

| 2006 |

14,467.0 |

4.0 |

| 2007 |

15,083.6 |

4.3 |

| 2008 |

14,513.1 |

-3.8 |

| 2009 |

14,328.3 |

-1.3 |

| 2010 |

14,652.4 |

2.3 |

| 2011 |

15,101.1 |

3.1 |

(IbisWorld)

Key industry drivers are those who can develop the cleanest and most efficient waste disposal services. We all throw away trash everyday, but what drives the industry is who can recycle that trash into the most effective reusable materials and products. As we move towards a more environmentally friendly and ‘green’ initiative life, there is a greater push towards producing reusable goods from our waste. This is a driver in this industry. The major players in this industry are Waste Management, Inc. which holds 24.9% of the market share, Republic Services Inc., which holds 19.6% of the market share, and Covanta, which holds 11.8% of the industry market share.

Covanta’s competitive advantage lies in it’s global reach and environmentally friendly energy recycling. Covanta is now the largest operator of waste-to-energy (WTE) plants in the United States. Covanta currently produces almost 5% of all US non-hydro renewable energy. The company owns, part owns, or operates 64 energy generation facilities, 56 of which are in the United States. The company also owns or operates a waste procurement business, three landfills, and several waste transfer stations. The company operates 34 waste-to-energy faculties (out of 89 such facilities in the United States), six biomass (wood waste) to energy facilities, and five landfill gas-to-energy facilities. (IBISWorld)

I believe my company will do well over the next three years. I believe this due to its acquisitions of other WTE companies and plants.

Posted in Waste Management Services, Covanta Holding Corporation | No Comments »

Mar

31

2011

Intro: Covanta Holdings Corporation (stock ticker CVA) is a developer, owner and operator of infrastructure for the conversion of waste to energy known as ‘energy-from-waste’, as well as other waste disposal and renewable energy production businesses in the Americas, Europe & Asia. Covanta takes its role as an environmental steward and global citizen very seriously. Protecting earth’s natural resources for future generations is a fundamental principal of Covanta’s mission. The Company conducts all of its operations through subsidiaries, which are engaged predominantly in the businesses of waste and energy services. Covanta is also engaged in the independent power production business outside the Americas. It has investments in subsidiaries engaged in insurance operations in California, primarily in property and casualty insurance. The Company operates in two segments: Americas and International. The Americas segment is comprised of waste and energy services operations primarily in the United States and Canada. The International segment is comprised of waste and energy services operations in other countries, the United Kingdom, Ireland, Italy, China, The Philippines, India, and Bangladesh (IBIS World, covantaenergy.com, Thomson One Banker, Worldscope).

History: At first it was mostly an investment company called Ogden Corporation, but it slowly turned into a manufacturing company. Ogden Corporation changed it’s name to Covanta in 2001 and in 2002 went bankrupt. In 2004, Danielson Holdings Corp acquired it.

Stock Ticker:

- Closing price on March 30, 2011: 17.03

- Closing price at year end 2010: 17.19

- Closing price at year end 2009: 18.09

- Closing price at year end 2008: 21.96

- Closing price at year end 2007: 27.66

- Closing price at year end 2006: 22.04

http://investors.covantaholding.com/phoenix.zhtml?c=115220&p=irol-stockLookup&t=HistQuote&control_firstdatereturned=

CEO: Mr. Anthony J. Orlando, 51, is President, Chief Executive Officer, Director of Covanta Holding Corp. He has served as President and Chief Executive Officer since October 2004. He has served as a director since September 2005 and is a member of the Finance Committee, the Public Policy Committee and the Technology Committee. Mr. Orlando’s one-year term as a director will expire at the next Annual Meeting. Previously, Mr. Orlando had been President and Chief Executive Officer of Covanta Energy since November 2003. From March 2003 to November 2003, Mr. Orlando served as Senior Vice President, Business and Financial Management of Covanta Energy. From January 2001 until March 2003, Mr. Orlando served as Covanta Energy’s Senior Vice President, Waste-to-Energy. Mr. Orlando joined Covanta Energy in 1987. Mr. Orlando’s first-hand knowledge and experience with the Company and the industry provides the Board with a greater understanding of all aspects of the Company’s business.

His total annual compensation at the end of 2010 was 1.3 million dollars. (Thomson One Banker, company people profiles)

Posted in Waste Management Services, Covanta Holding Corporation | 190 Comments »